Google revealed it is abandoning its highly anticipated plans to offer bank accounts to its users, according to reports from the Wall Street Journal.

Originally coined “Plex,” the Alphabet Inc. unit introduced the option in 2019 with the intent that users of its Google Pay digital wallet would be able to sign up for checking accounts and debit cards at a number of financial institutions.

Those institutions included Citigroup and Stanford Federal Credit Union who had originally partnered with the tech giant for the bank accounts release. Citi and Google had established a partnership where Google provides the consumer-facing front-end to digital banking services while the accounts will be held by Citi, along with other FDIC-backed banks Google has partnered with.

Google later signed up several more partners for the co-branded digital accounts that were to be built on top of the banks’ existing infrastructure with plans to launch in 2020.

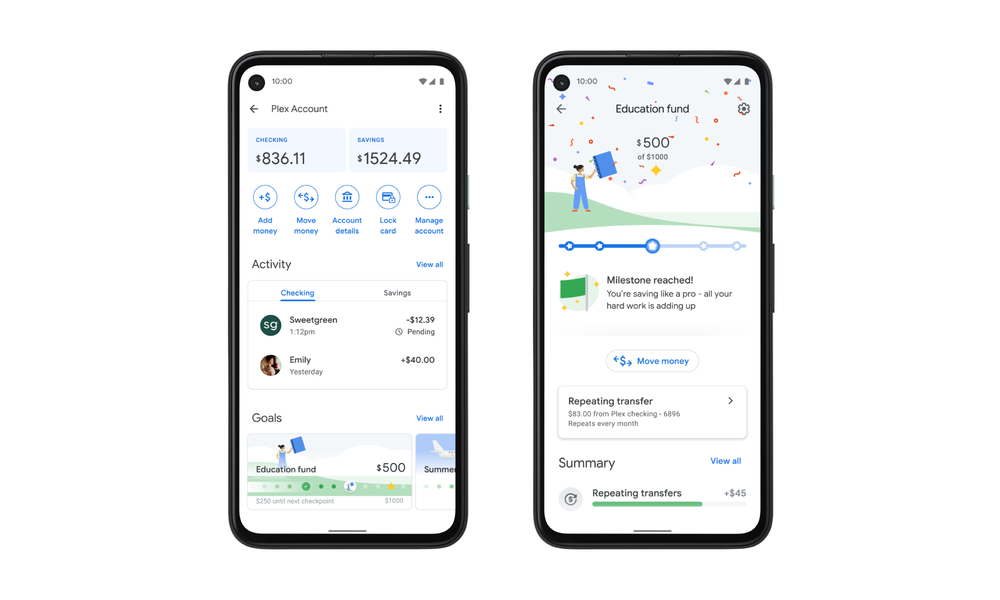

According to Google, the Plex accounts would offer functions that could sync with Google Pay, carry both Google and bank branding and provide a digital dashboard for users to see how they spent and saved. People familiar with the matter told the WSJ that a series of missed deadlines, along with the April departure of the Google Pay executive who championed the project, prompted Google to pull the plug on Plex.

The project desertion comes at a time when many of the Silicon Valley giants are making moves in the financial landscape to lock in their customers’ allegiance; Amazon revealed plans to develop its own PoS system, and Apple released a credit card that paired with the iPhone.

However, according to a Google spokesperson, the company is now planning to focus on ““delivering digital enablement for banks and other financial services providers rather than us serving as the provider of these services.” A let down for the 10,000 users Citi was purportedly seeing added to the account’s waitlist, which had swelled to around 400,000 by the time the plug was pulled.

In 2020, Google did manage to expand its digital finance projects with the partnership of U.K.-based startup Fidel. The merchant-funded offers that live in the Google Pay app are supported by Fidel’s API, which captures real-time transactions from linked payment cards, and enables companies to trigger real-time engagement between consumers and merchants at the point of purchase.

At the time of that partnership, Josh Woodward, director of Google Pay expressed a similar goal to Plex’s – create opportunities for merchants to deepen relationships with customers while creating Google Pay incentives.

Aside from the architect of the Plex project, Caesar Sengupta, leaving Google in April, the state of the pandemic also threw the project off schedule last year.

As late as this week, several banks were under the impression that the project would still move forward, the WSJ reported. On Monday, BM Technologies Inc. told the publication its Plex accounts would arrive in late 2021 or 2022. “Google and BMTX are excited about this opportunity and are committed to this partnership,” the banking platform said in an email at the time.